Are you searching for 'case study on government budget 2018 19'? Here, you will find all the stuff.

Table of contents

- Case study on government budget 2018 19 in 2021

- What is the purpose of the federal budget

- How many districts will be covered under the scheme for the fiscal 2018-19?

- Sector wise allocation of budget 2019-20

- Union budget 2019-20 highlights

- Budget 2019 pdf

- Budget 2018-19 india pdf

- Key features of budget 2018-19 pdf

Case study on government budget 2018 19 in 2021

This image demonstrates case study on government budget 2018 19.

This image demonstrates case study on government budget 2018 19.

What is the purpose of the federal budget

This image representes What is the purpose of the federal budget.

This image representes What is the purpose of the federal budget.

How many districts will be covered under the scheme for the fiscal 2018-19?

This picture representes How many districts will be covered under the scheme for the fiscal 2018-19?.

This picture representes How many districts will be covered under the scheme for the fiscal 2018-19?.

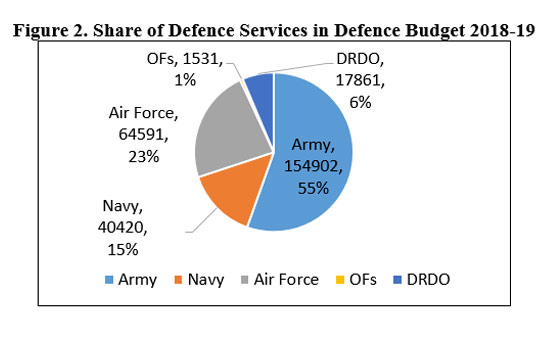

Sector wise allocation of budget 2019-20

This picture representes Sector wise allocation of budget 2019-20.

This picture representes Sector wise allocation of budget 2019-20.

Union budget 2019-20 highlights

This image illustrates Union budget 2019-20 highlights.

This image illustrates Union budget 2019-20 highlights.

Budget 2019 pdf

This picture illustrates Budget 2019 pdf.

This picture illustrates Budget 2019 pdf.

Budget 2018-19 india pdf

This picture demonstrates Budget 2018-19 india pdf.

This picture demonstrates Budget 2018-19 india pdf.

Key features of budget 2018-19 pdf

This image representes Key features of budget 2018-19 pdf.

This image representes Key features of budget 2018-19 pdf.

What are the highlights of Union Budget 2018-19?

Highlights of Union Budget 2018-19 Overview of the economy The GDP grew at 6.3 per cent in the second quarter of 2017-18 and is expected to grow at 7.2-7.5 per cent in the second half of 2017-18. Growth for 2018-19 is forecasted at 7.4 per cent by the International Monetary Fund (IMF).

Which is a major concern surrounding the Budget 2018?

One of the major concerns for surrounding the Budget will be the collection of tax after the implementation of GST during the year. GST was implemented with an intention to increase tax compliance along with erasing duplicity of taxes across states.

How is the budget presented to the Parliament?

Estimates expenditures and receipts are planned as per the objectives of the Government. The budget is presented in the parliament on such a day, as the President may direct. By conventions, it is presented, before it can be implemented. It is required to be approved by the parliament.

What was the budget for 2018-19 in India?

Total budgeted expenditure for 2018-19 is set at Rs 2,442,213 crore (US$ 383.93 billion). Central Government’s debt to GDP ratio will be brought down to 40 per cent, as per the recommendations of the Fiscal Reform and Budget Management Committee.

Last Update: Oct 2021