Are you seeking for 'tesla bear thesis'? You can find your answers here.

Table of contents

- Tesla bear thesis in 2021

- Why is tesla growing so fast

- Visual capitalist tesla

- Tesla biggest company in the world

- Europe leads in ev sales but for how long

- Tesla top company

- Most valuable automaker

- Tesla fortune 500

Tesla bear thesis in 2021

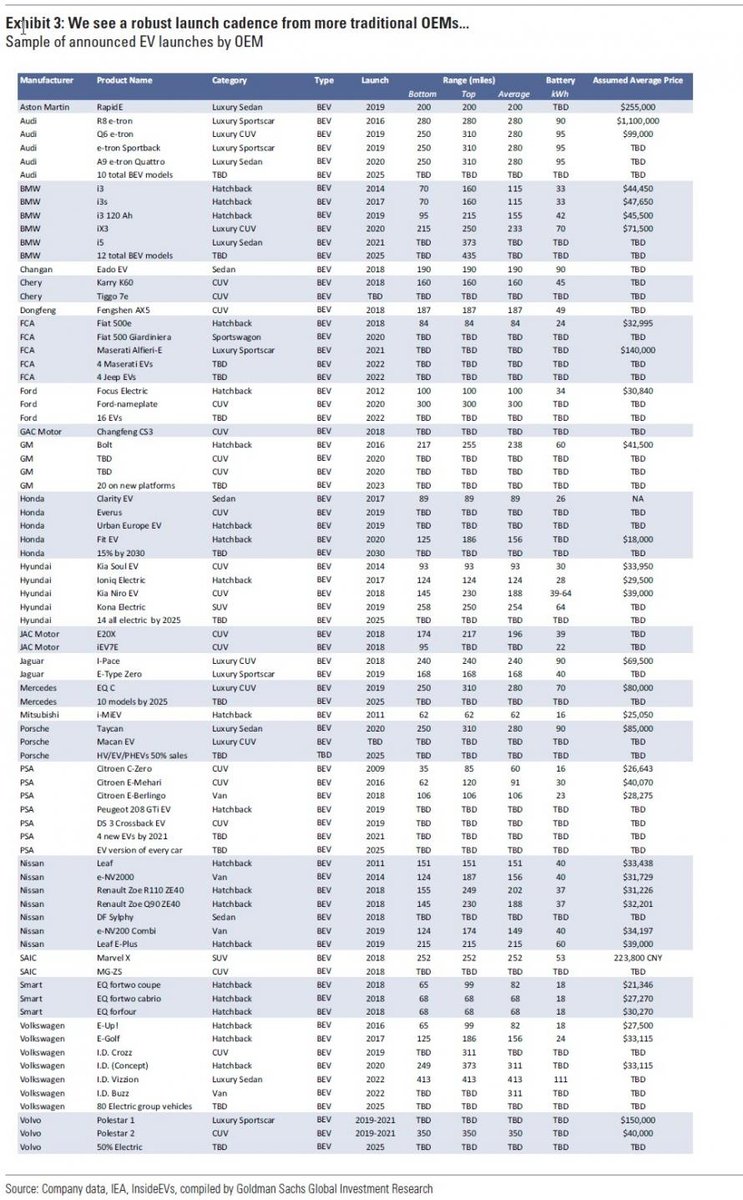

This picture shows tesla bear thesis.

This picture shows tesla bear thesis.

Why is tesla growing so fast

This picture illustrates Why is tesla growing so fast.

This picture illustrates Why is tesla growing so fast.

Visual capitalist tesla

This image shows Visual capitalist tesla.

This image shows Visual capitalist tesla.

Tesla biggest company in the world

This image representes Tesla biggest company in the world.

This image representes Tesla biggest company in the world.

Europe leads in ev sales but for how long

This image illustrates Europe leads in ev sales but for how long.

This image illustrates Europe leads in ev sales but for how long.

Tesla top company

This picture representes Tesla top company.

This picture representes Tesla top company.

Most valuable automaker

This picture shows Most valuable automaker.

This picture shows Most valuable automaker.

Tesla fortune 500

This image demonstrates Tesla fortune 500.

This image demonstrates Tesla fortune 500.

What is the price target for Tesla stock?

In our bull case, ARK estimates that, as robotaxis ramp, Tesla’s insurance revenues will be incorporated into a platform fee. Insurance boosts our price target by roughly $60 in 2025. ARK’s bear case now includes Tesla’s opportunity to launch a human-driven ride-hail service.

What kind of EBIT margin does Tesla have?

Because its vehicles have better than average safety profiles, Tesla should be able to use real-time data to offer insurance in its vehicles, pricing it dynamically, lowering customer acquisition costs, and increasing margins. Relative to Progressive’s 13% EBIT margin in 2019, ARK estimates that Tesla could achieve margins close to 40%.

Is the Tesla a good investment for Ark?

ARK’s bear case now includes Tesla’s opportunity to launch a human-driven ride-hail service. Previously, ARK detailed that a Tesla human-driven ride-hail service would have a lower cost structure than that of incumbent companies, laying the foundation for a fully autonomous ride-hail network.

How big is the short interest in Tesla?

Short interest on Tesla, which hovers at just over 5.34%, is valued at over $23 billion — making it the largest short in the U.S. market by total value. In contrast, the average short interest ratio for stocks in the S&P 500 is currently around 3%. So, what’s the bear thesis this time?

Last Update: Oct 2021

Leave a reply

Comments

Sarajean

19.10.2021 07:44Refreshing customers can pull through 30% on their first order now. That's ambitious, but atomic number 85 the current charge per unit, the company should be able to exceed its expectations.

Shawneen

19.10.2021 05:31The company receives oversized attention compared to any other. Tesla is probably one of the most polarizing companies in past times.

Aristotelis

24.10.2021 11:30Fashionable our bear case example, ride-hail could add an additive $20 billion to tesla's operating gain by 2025, accelerando our price objective by about $500.